- HISD Human Resources

- Information for Current & Former Employees

W-2 Information

ACTIVE EMPLOYEES

How do I retrieve my W-2 form?

If you are an active employee and selected the option to receive your W-2 by mail, your W-2 will be mailed to your current home address by January 31st.

If you are an active employee and selected the option to retrieve your W-2 electronically, you can access your 2024 W-2 by following these steps:

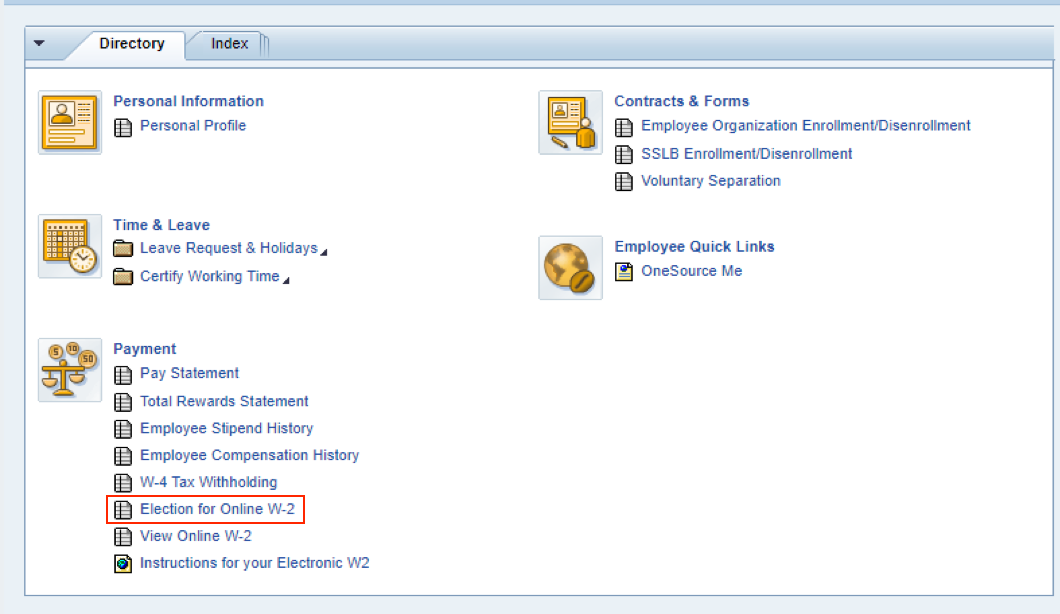

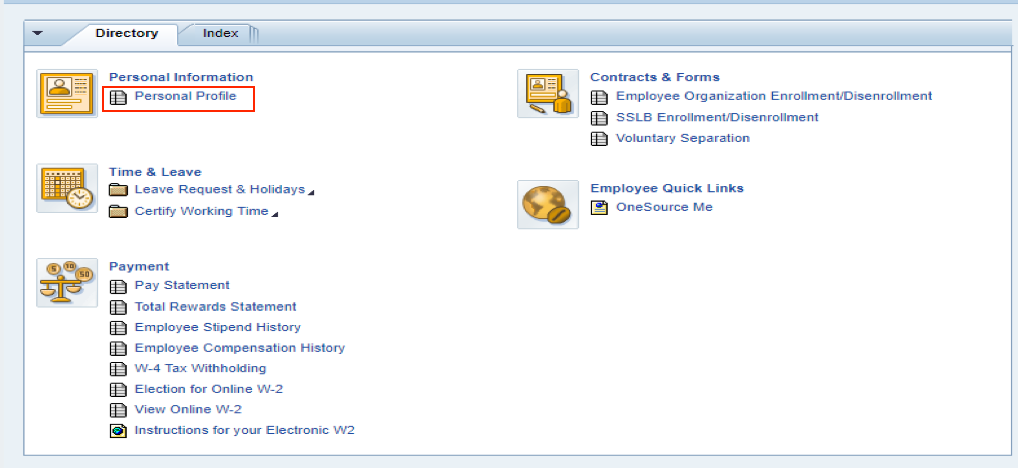

- Log in to your Employee Self-Service (ESS) account by clicking the following link: HISD ESS.

- Once logged in, click on View Online W-2

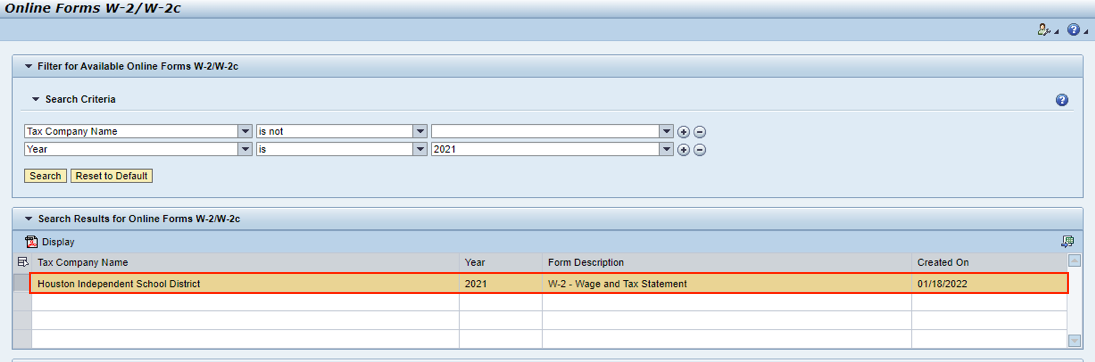

- Select Houston Independent School District (Year) 2024 W-2 Wage and Tax Statement.

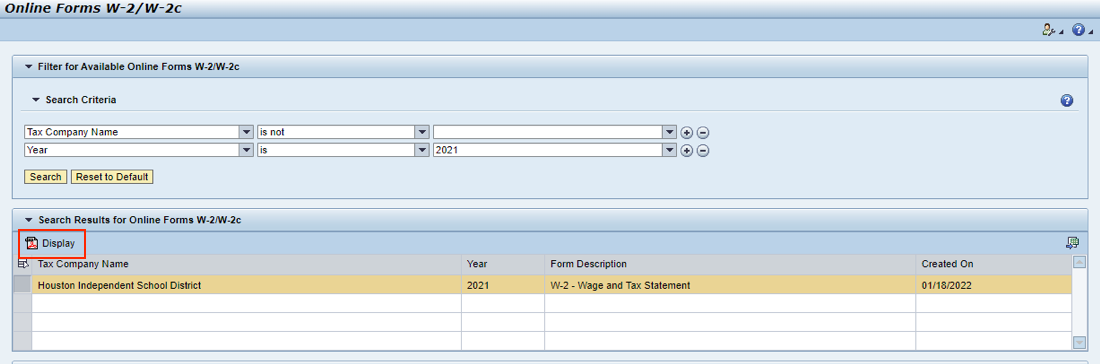

- Select Display.

- Your W-2 form will populate under the Display W-2/W2c tab. If your W-2 does not populate, try using a different web browser.

I am an active employee who requested my W-2 to be mailed; however, my address is incorrect. What steps should I follow to ensure my 2024 W-2 is mailed to me?

The deadline to update your current address to ensure receipt of your 2024 W-2 by mail by January 31, 2025, is January 17, 2023. If this deadline is missed, a reprint can be requested by following these steps:

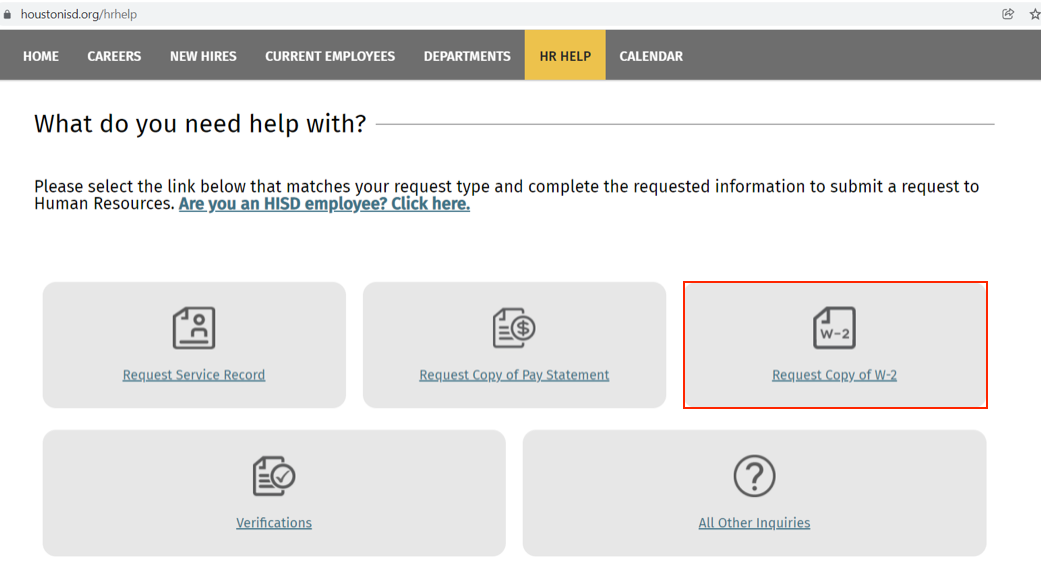

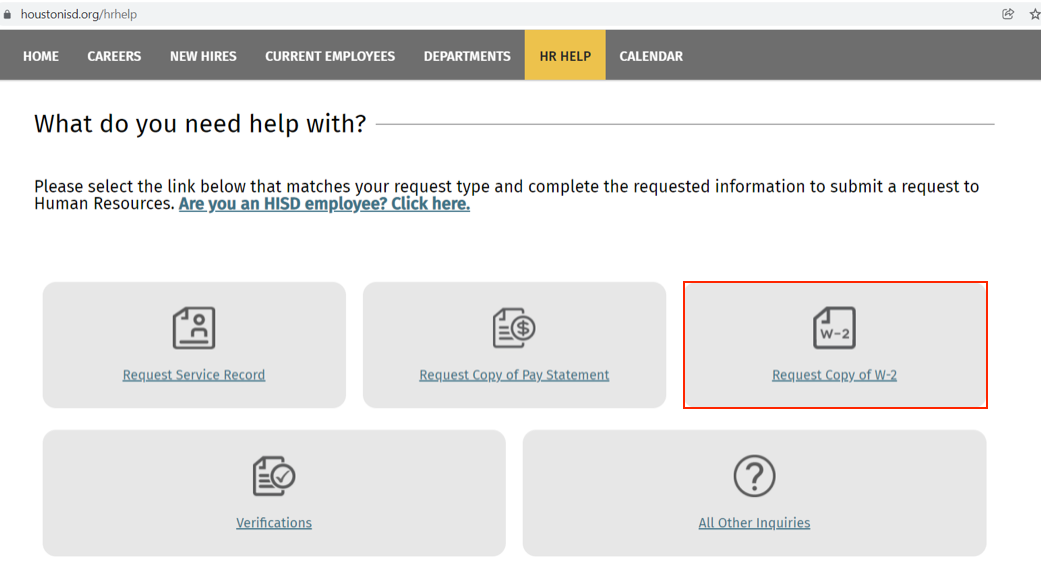

- Visit www.houstonisd.org/hrhelp and select Request Copy of W-2.

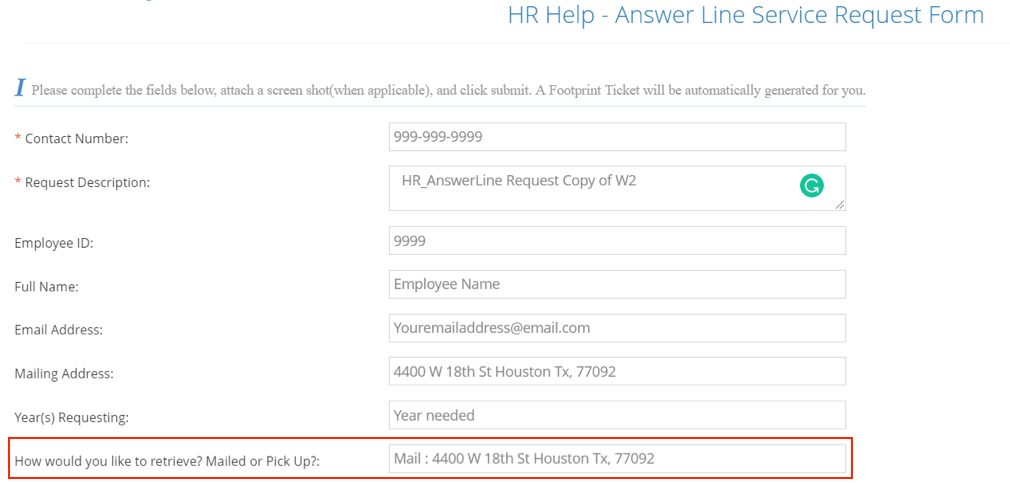

- If you are requesting for your W-2 to be mailed, please provide your address to include your full Street Address, City, State, and Zip Code.

- If you are requesting to retrieve your W-2 from our office, reprints will be released starting the week of February 3, 2025. Please provide an accurate email address and contact number and an Employee Services Associate will contact you to schedule an appointment.

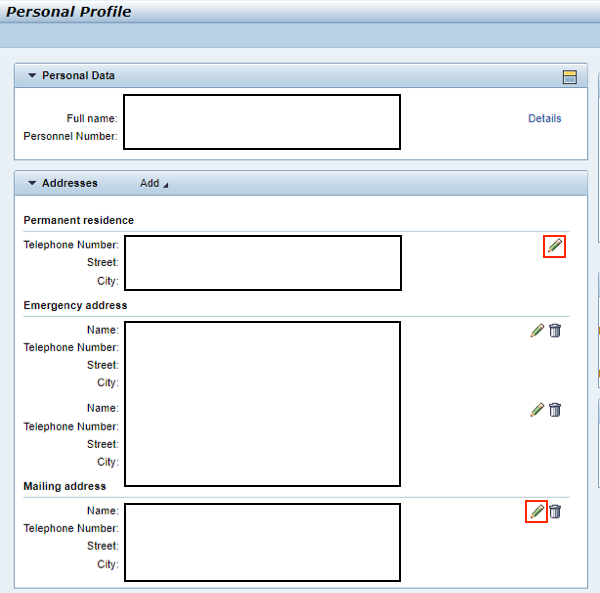

- In addition, please review your personal profile by OneSource, Employee Self Service to update your address. Log in to your Employee Self-Service (ESS) account by clicking the following link: HISD ESS and select Personal Profile.

- Select the pencil tool, update your address and phone number, and click save.

I selected the option to receive my W-2 by mail. Will I have the option to view my W-2 online also?

No. By selecting the option to receive your W-2 by mail, the electronic version will not be available for you.

What happens if I selected the option to receive my W-2 by mail, my current address is correct, but I have not received my W-2?

Your 2024 W-2 will be mailed to you by January 31, 2025. If you have not received your W-2 by this date, you must request a reprint. Reprints will be available starting the week of February 3, 2025.

Why do my wages on my W-2 not reflect my wages on my last pay statement of the year?

Your W-2 reflects your taxable earnings while your pay statement reflects your total earnings. Only your taxable earnings are being reported to the IRS. To calculate your taxable earnings, subtract your total pre-tax deductions from your total earnings. These are the earnings reported to the IRS.

Why does my W-2 not reflect my annual salary?

The fiscal year of the two components differ and for this reason the two will never reflect the same amount. Your W-2 reflects your total earnings from January 1st – December 31st of the taxable year, while your annual salary reflects your fiscal school year to date earnings, September - August.

What happens if my W-2 reflects no federal taxes withheld?

Federal taxes withheld is based on how you completed your W-4 form. Your filing status and exemptions play an important part on how your earnings are taxed. We recommend speaking with your tax preparer or a Certified Public Accountant for advice. You can update your W-4 anytime by accessing W4 tax withholding in OneSource, Employee Self Service. HISD ESS

Why is there a figure identified in Box #14 on my W-2?

Employers use this box to report information such as state and disability insurance taxes withheld, union dues, and health insurance premium deductions.

What is a 1095-C form?

The 1095-C form is documentation that confirms benefit coverage for the current tax year. 1095-C forms will be released February 2025 and is not required when filing your taxes.

My Social Security number is incorrect on my W-2. What should I do?

If your social security number is incorrect on your W-2, please contact Human Resources Employee Services at 713-556-7400 Option 5.

What does DD mean in box #12A?

DD means cost of employer sponsored health coverage. The amount reported with code DD is not taxable.

Why is Box #13 (Retirement Plan) checked?

If the “Retirement Plan” (Box #13) is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub. 590-A, Contributions to Individual Retirement Arrangements (IRAs).

INACTIVE EMPLOYEES

I am an inactive employee. When will I receive my 2024 W-2?

All inactive employees will receive their 2024 W-2 by mail. W-2’s will be mailed to the address identified on your profile as of January 17, 2025.

NOTE: Inactive employees will not have access to retrieve their W-2 electronically. Access to HISD’s network expired at separation.

I am an inactive employee. When is the deadline to update my address to ensure I receive my W-2 by January 31, 2025?

If you are an inactive employee the deadline to update your current address to ensure receipt of your 2024 W-2 by January 31, 2025, is January 17, 2025. If this deadline is missed, a reprint can be requested by following these steps:

- Visit www.houstonisd.org/hrhelp and select Request Copy of W-2.

- If you are requesting for your W-2 to be mailed, please provide your address to include your full Street Address, City, State, and Zip Code.

- If you are requesting to retrieve your W-2 from our office, please provide an accurate email address and contact number and an Employee Services Associate will contact you to schedule an appointment.