-

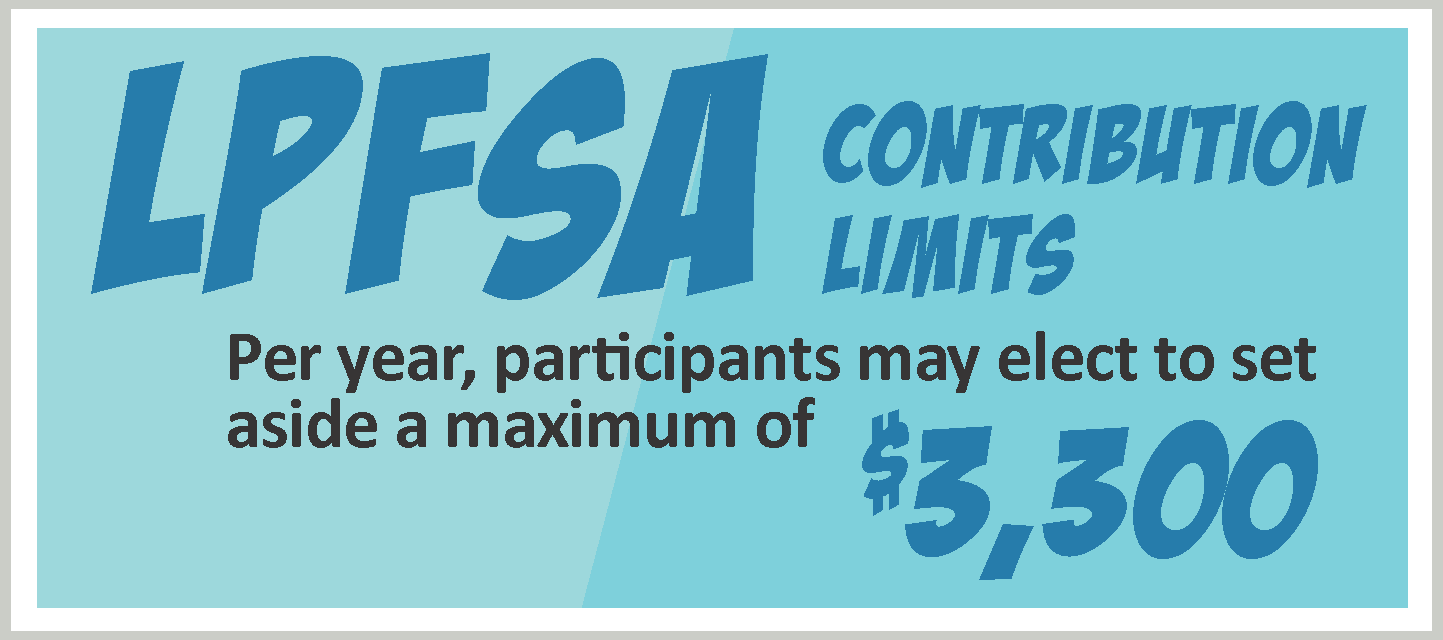

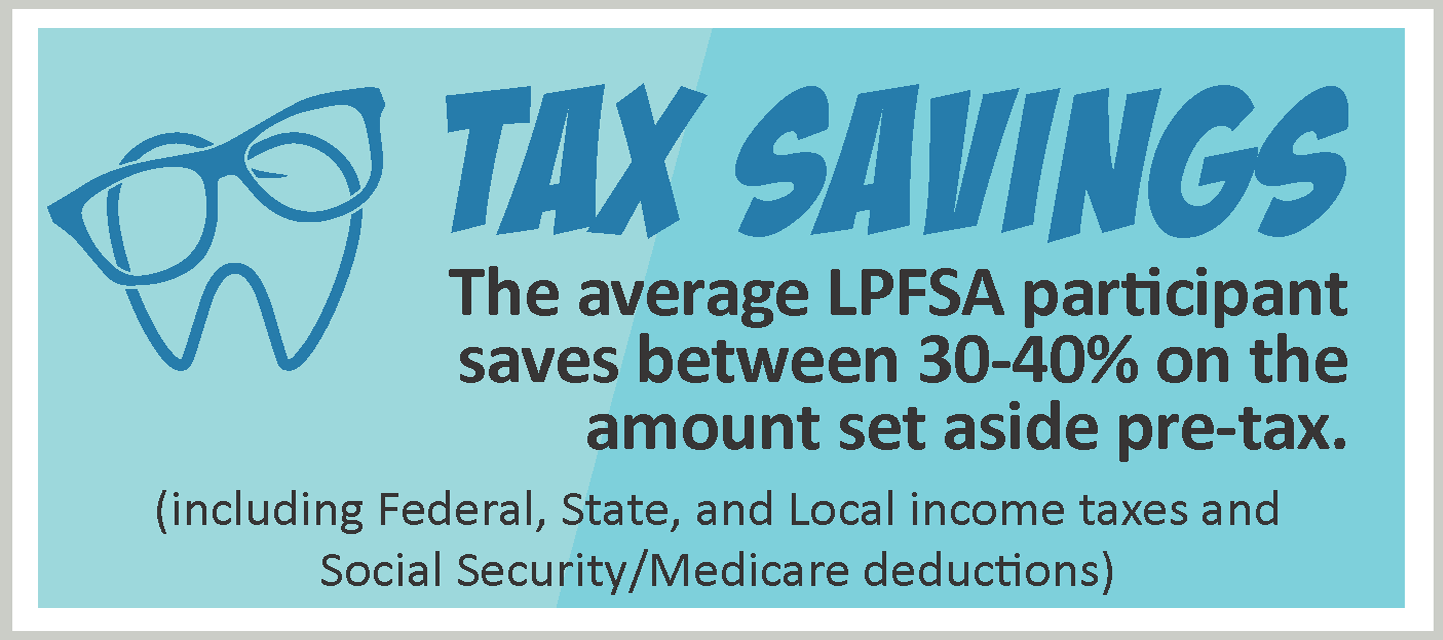

Limited Purpose Flexible Spending Account (LPFSA)

A Limited Purpose Flexible Spending Account allows employees to set aside money from each paycheck, before payroll taxes are calculated to help pay for eligible vision and dental expenses for themselves and their dependents.

-

LPFSA Plan Provisions

LPFSA rules vary by plan. Your employer may choose one of the following:

- Use it or Lose it – All LPFSA funds must be spent by the end of the plan year, or they are lost

- Carryover – Any unused funds, up to a maximum of $640, can be carried over from one plan year to the next

- Grace Period – Participants get an extra 2½ months after the end of the plan year to use any leftover funds

-

Uniform Coverage Rule

LPFSA participants can access the full amount of their annual contribution from the first day of the plan year. For example, if you elect $1,300, and soon aer the plan year begins you incur a $1,300 dental bill, you can use all of your elected LPFSA funds to cover the expense, even though you haven’t paid in all the contributions yet.

Throughout the rest of the plan year, deductions will be taken at the same rate as each paycheck. However, your available LPFSA balance will be zero once all the funds are spent.

-

Learn more

Contact your Benefits Representative for a list of eligible expenses.