-

Are you eligible for benefits?

You can participate in HISD benefits plans if:

- You’re a regular part-time or full-time employee as defined by HISD and a contributing member of the Teachers Retirement System (TRS)

- You're retired from TRS and rehired into a position that is eligible for benefits

- You qualify as a full-time employee as defined under Section 4980H(c)(4) of the Internal Revenue Code

Benefits appeals process:

If you have applied for benefits and been denied and have extenuating circumstances, you have the right to appeal your benefits enrollment status. To appeal your status, call the HISD Benefits Service Center at 1-877-780-4473. Click here for the appeal form. Please note that the appeals process does not review carrier claim issues. For those issues, you must contact the carrier directly.

Are your dependents eligible?

Some benefits are available to your dependents if they meet the eligibility rules of the plan.

Eligible dependents include:- Your legal spouse

- Your dependent children

Eligible dependent children under 26 years of age include:

- Your biological children

- Your stepchildren

- Your legally adopted children

- Your foster children, including any children placed with you for adoption

- Your child who qualifies as your dependent under the terms of a qualified medical child support order (QMSCO)

- Your grandchild (you must have legal custody or legal guardianship of the child)

Your child (age 26 or over) that otherwise meets the requirements above may be eligible for dependent coverage, provided the child is either mentally or physically incapacitated to such an extent to be dependent on you on a regular basis as determined by HISD Benefits Office medical partners and meets other requirements as determined. To avoid any gap in coverage, the forms must be submitted and approved prior to the end of the month the child turns 26. Contact HISD Benefits Office at 713-556-6655 for assistance completing the Disabled Dependent application.

Eligible dependent grandchildren under the age of 25 may be covered if you provide required documentation.

Dependent verification

You're required to provide documentation to support the eligibility status of each of your dependents. It’s a simple process you only need to complete once, unless you drop a dependent from your coverage and then add him or her back later. You and your dependents may lose benefits or eligibility if you're covering individuals who don't meet the definition of an eligible dependent. For complete details, call the HISD Benefits Service Center at 877-780-HISD (4473).

For a child, one of these documents verifies eligibility:- Adoption certificate

- Adoption placement agreement

- Birth certificate with parent’s name listed

- Documentation of legal custody

- Documentation of legal guardianship

- Hospital birth record (within 90 days of birth)

- Qualified medical child support order

For a spouse, one of these documents verifies eligibility:*

- Declaration of informal marriage (showing actual date of marriage)

- Marriage license or certificate (showing actual date of marriage)

*If your dependent is a stepchild, you must also provide a copy of a marriage certificate to substantiate the child’s relationship to the employee or spouse.

If you have questions, please call the HISD Benefits Service Center at 877-780-HISD (4473).

When do benefits begin?

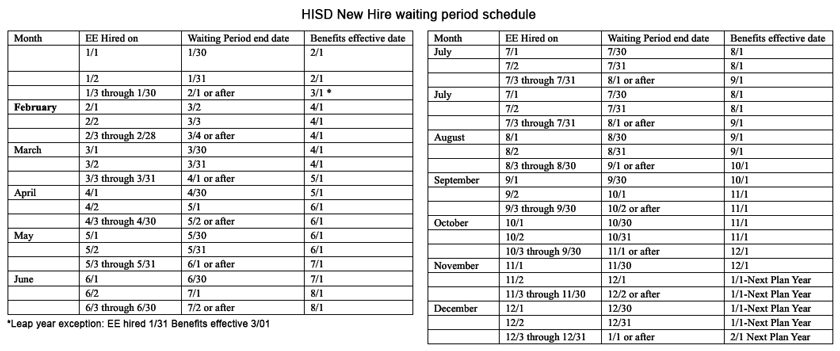

If you are a new employee, a rehire outside of 31 days or newly eligible, your benefits coverage begins on your benefits effective date, which is the first of the month following 30 days after your new employee date of hire or transfer date for the newly eligible, as long as you select benefits before your benefits effective date or the date you become eligible for benefits. For example, if you start work or become benefits eligible on February 12, your benefits begin April 1, as long as you select your benefits before April 1. For benefits selected during the annual enrollment period, coverage begins January 1 of the following year. For benefits requiring evidence of insurability, coverage begins the beginning of the month following carrier approval of your application. See chart below for effective dates.*If you are rehired within 30 days of your benefits ending, your benefits will bridge or reinstate to your prior coverage.

When do benefits end?

Benefits coverage ends on the earliest of:- The date the plan ends

- The last day of the month in which you are no longer eligible

- The date you stop paying for coverage

- The last day of the month after you notify the district of your selection to stop participation based on annual enrollment or a qualified life event or a family status change (if the family status change is reported within 31 days of the event)

- The last day of the month in which you stop working for the district

Learn how the Affordable Care Act affects you:

Also known as healthcare reform, the Affordable Care Act (ACA) has brought many changes to health care in the US, providing benefits like free preventive care and coverage for adult children until age 26. Everyone is required to have healthcare coverage that meets the ACA’s minimum guidelines for affordability and value. If you don’t, you may have to pay a fee on your federal tax return. All of HISD’s medical plan options meet ACA guidelines, so if you’re enrolled in one of our plans, you’re not subject to paying the fee.

HISD coverage option ratings:

ACA rates medical plans based on their actuarial value, which is the percentage of expenses paid for by the plan, and distinguishes them by metal levels from bronze to platinum.

Here’s how our plans are rated:- Basic and Plus: Silver

- Select Plan: Gold

Where you can purchase coverage that meets ACA requirements:

- HISD (if you’re eligible)

- Another employer or a spouse’s employer

- A government plan such as Medicare or Medicaid (or CHIP for your covered dependents)

- An insurance company

- The federal Health Insurance Marketplace

You can make changes to your HISD plan, including dropping coverage completely, during annual enrollment. If you drop your HISD coverage, you can’t regain district coverage until annual enrollment the following year unless you have a qualified life event (such as getting married or giving birth). Keep in mind you forfeit HISD’s contribution to your coverage when you choose a non-district option.

IRS Form 1095-C:

The IRS requires you to verify and report your medical plan eligibility, coverage selection, and covered dependents’ tax ID numbers through IRS Form 1095-C. HISD sends this form to full-time employees, as well as part-time employees enrolled in a district medical plan. The form allows you to verify that you—and your spouse and dependents, if applicable—were offered and had qualifying coverage for some or all months of the previous year. This is important whether you were enrolled in an HISD medical plan or chose to purchase coverage elsewhere. Though you’re not required to submit Form 1095-C with your tax return, you do need to keep it with your records in case the IRS requests it.

Click here for more information, visit the IRS website or talk to your tax advisor. You can also call HISD Employee Services at 713-556-7400, option 1 then option 5.

Have questions?

Visit healthcare.gov for more information about health care reform.

Select a School...

Select a School

- Alcott Elementary School

- Almeda Elementary

- Alternative Certification Program

- Anderson Elementary School

- Arabic Immersion Magnet School (AIMS)

- Ashford Elementary

- Askew Elementary School

- Atherton Elementary

- Attucks Middle School

- Austin High School

- Baker Montessori

- Barbara Bush Elementary

- Barbara Jordan Career Center

- Barrick (C. E.) Elementary

- Bastian Elementary School

- Baylor College of Medicine Academy at James D Ryan MS

- Baylor College of Medicine Biotech Academy at Rusk

- Bellaire High School

- Bellfort Early Childhood Center

- Benavidez Elementary

- Benbrook Elementary

- Berry Elementary

- Billy Reagan K8 Educational Center

- Frank Black Middle School

- Blackshear Elementary

- Bonham Elementary School

- Bonner Elementary

- Braeburn Elementary

- Briargrove Elementary School

- Briarmeadow Charter

- Briscoe Elementary

- Brookline Elementary

- Browning Elementary

- Bruce Elementary

- Burbank Elementary

- Burbank Middle

- Burrus Elementary

- Cage Elementary

- Career Readiness

- Carnegie Vanguard High School

- Carrillo Elementary

- Challenge Early College High School

- Clemente Martinez Elementary School

- Clifton Middle School

- Codwell Elementary

- Community Services

- Condit Elementary

- Coop Elementary

- Cornelius Elementary

- Crespo Elementary

- Crockett Elementary School

- Cullen Middle School

- Cunningham Elementary

- César E. Chavez High School

- Daily, Ray K. Elementary

- David G. Burnet Elementary

- Davila Elementary

- De Chaumes Elementary

- De Zavala Elementary

- Deady Middle School

- DeAnda Elementary School

- Distrito Escolar Independiente de Houston

- Dogan Elementary School

- Durham Elementary

- Durkee Elementary

- East Early College High School

- Eastwood Academy

- Edison Middle School

- Elementary DAEP

- Eliot Elementary School

- Elmore Elementary School

- Elrod Elementary School

- Emerson Elementary

- Energized for Excellence

- Energy Institute High School

- McGowen Elementary

- Farias ECC

- Cook Elementary

- Field Elementary School

- Fleming Middle School

- Foerster Elementary

- Fondren Elementary

- Fondren Middle School

- Fonville Middle School

- Fonwood Early Childhood Center

- Forest Brook Middle School

- Franklin Elementary

- Frost Elementary

- Furr High School

- Gabriela Mistral CEC

- Gallegos Elementary

- Garcia Elementary School

- Garden Oaks Montessori

- Garden Villas Elementary

- Golfcrest Elementary

- Gregg Elementary

- Gregory-Lincoln Education Center

- Gross Elementary

- Halpin Early Childhood Center

- Hamilton Middle School

- Harper DAEP High School

- Harris (John R.) Elementary

- Harris (Roland P.) Elementary School

- Hartman Middle School

- Hartsfield Elementary School

- Harvard Elementary School

- Health and Medical Services

- Heights High School

- Helms Elementary School

- Herod Elementary School

- Herrera Elementary School

- High School Ahead Academy Middle School

- High School for Law and Justice (HSLJ)

- Highland Heights Elementary

- Hilliard Elementary School

- Hines Caldwell Elementary School

- HISD Benefits

- HISD Human Resources

- HISD Miles Ahead Scholars

- HISD School Choice

- HISD School Website Resources

- Hobby Elementary School

- Hogg Middle School

- Holland Middle School

- Horn Elementary

- Houston Academy for International Studies

- Isaacs Elementary

- J.P. Henderson Elementary

- Long Academy

- Janowski Elementary

- Jefferson Elementary School

- John G. Osborne Elementary

- Jones Futures Academy

- Kashmere Gardens Elementary Fine Arts Magnet

- Kashmere High School

- Kate Bell Elementary

- Smith, K. Elementary

- Kelso Elementary

- Kennedy (John F.) Elementary

- Ketelsen Elementary

- Key Middle School

- Kinder High School for the Performing and Visual Arts

- Kolter Elementary

- Lamar High School

- Lanier Middle School

- Lantrip Elementary

- Las Americas

- Laurenzo Early Childhood Education Center

- James H. Law Elementary

- Lawson Middle School

- Lewis Elementary

- Liberty High School Homepage

- Lockhart Elementary School

- Longfellow Elementary School

- Looscan Elementary

- Love Elementary School

- Lovett Elementary School Fine Arts Magnet

- Lyons Elementary School

- Mabel B. Wesley Elementary School

- MacGregor Elementary School

- Mading Elementary STEM Academy

- Madison (James) High School

- Mandarin Immersion

- Marcellus Elliot Foster Elementary

- Twain (Mark) Elementary

- Mark White Elementary School

- Marshall Middle Academy of Fine Arts

- Martin Luther King, Jr. Early Childhood Center

- McNamara Elementary

- McReynolds Middle School

- Medicaid Finance & Consulting Services

- Memorial Elementary

- Meyerland Performing and Visual Arts Middle School

- DeBakey High School for Health Professions

- Mickey Leland College Preparatory Academy for Young Men

- Gulfton

- Middle College at Felix Fraga

- Milby High School

- Milne Elementary School

- Mitchell Elementary School

- Montgomery Elementary

- Moreno, Joe E. Elementary

- Henderson Elementary School

- Neff Early Learning Center

- Neff Elementary School

- North Forest High School

- North Houston Early College HS

- Northline Elementary

- Northside High School

- Oak Forest Elementary School

- Oates Elementary

- Ortiz Middle School

- Paige Elementary

- Park Place Elementary School

- Parker Elementary

- Henry Middle School

- Patterson Elementary

- Paul Revere Middle School

- Peck Elementary

- Pershing Middle School

- Petersen Elementary

- Pilgrim Academy

- Pin Oak Middle School

- Piney Point Elementary School

- Pleasantville Elementary School

- Poe Elementary

- Port Houston Elementary School

- Project Chrysalis Middle School

- Pugh Elementary

- Raul Martinez Elementary

- Red Elementary

- Redesign

- Reynolds Elementary

- River Oaks Elementary IB World School

- Roberts Elementary

- Robinson Elementary

- Rodriguez, Sylvan Elementary

- Roosevelt Elementary

- Ross (Betsy) Elementary School

- Rucker Elementary

- Sam Houston Math, Science and Technology Center

- Sanchez Elementary

- Scarborough Elementary

- Scarborough High School

- Scroggins Elementary School

- Secondary DAEP

- Seguin Elementary

- Shadowbriar Elementary

- Shadydale Elementary School

- Sharpstown High School

- Sharpstown International School

- Shearn Elementary School

- Sherman Elementary School

- Sinclair Elementary School

- South Early College High School

- Southmayd Elementary School

- Sterling Aviation High School

- Stevens Elementary

- Stevenson Middle School

- Student Supports

- Students

- Sugar Grove Academy Middle School

- Sutton Elementary

- T.H. Rogers School

- Tanglewood Middle School

- Texas Connections Academy at Houston

- Texas Education

- The Rice School La Escuela Rice

- The School at St George Place

- Thomas Middle School

- Thompson Elementary

- Thurgood Marshall Elementary School

- Tijerina Elementary

- Tinsley Elementary

- Travis Elementary School

- Valley West Elementary

- Virgil I. Grissom Elementary School

- Wainwright Elementary

- Walnut Bend Elementary

- Waltrip High School

- Washington High School

- Welch Middle School

- West Briar Middle School

- West University Elementary School

- Westbury High School

- Westside High School

- Wharton Dual Language Academy

- Wheatley High School

- Whidby Elementary

- White (Ed) Elementary

- Whittier Elementary School

- Williams Middle School

- Windsor Village Vanguard Magnet Elementary

- Wisdom High School

- Woodson PK-5 Leadership Academy

- Worthing High School

- Yates High School

- Navarro Middle School

- Young Elementary

- Young Scholars Academy for Excellence

- YWCPA