FAFSA Step-by-Step Process

Click each step below for detailed instructions.

Overview

The FAFSA Process

Below, excellent video of the FAFSA process.

|

Texas Colleges: FAFSA/TASFA Priority Deadlines |

| Step 01: | Gather Documents and create FSA ID |

| Step 02: | Completing the FAFSA and checking your SAR (EFC). |

| Step 03: | Follow up after FAFSA submission and Verification. |

| Step 04: | Accepting your Award Letter. |

Are you ready?

Click on the "Next" button below and lets get started!

Gathering Documents

Step 1: Gathering Documents and FSA ID

Apply for your FSA ID for you and one parent at https://studentaid.ed.gov/npas/index.htm .

The following information is needed to complete your FAFSA:

| Social Security number for you and your parents |

| DOB for you and your parents. |

| Date (month/year) your parents were married or divorced. |

| Your family’s 2017 tax returns (1040) and W-2 |

| Permanent Residency card if not a citizen. |

However, if your parents are required to submit a tax returns then you will need them to submit their taxes; otherwise, you risk not having your FAFSA processed.

Complete the FAFSA

Step 2: Completing your FAFSA and checking your SAR (EFC)

Start your FAFSA at www.fafsa.ed.gov

The 6 parts of a FAFSA Application. Click each step for important hints on completing the FAFSA

- Complete the FAFSA for the year you will start college.

- If you are a permanent resident, refugee, or have an approved asylum case, click [No, but I am an eligible noncitizen].

- Your driver’s license is optional.

- Males make sure to click [Register me] for selective service. If you do NOT, you will not receive financial aid.

- Graduating seniors should choose never attended college/1st year even if they took dual credit and AP classes.

- Always consider clicking [YES] that you are interested in work-study. This is a great way to make extra money for college while attending classes.

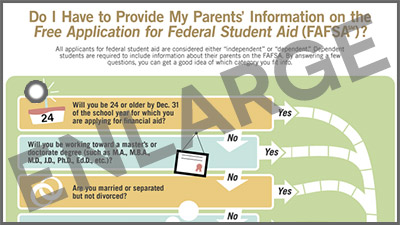

- If you answer [Yes] to any question here you will be classified as a [independent student]. You will not be required to supply income or tax information for your parents.

- If you answer [No] to all of the questions you will be classified as a [dependent student] and you will need to include your parents on your FAFSA.

- If you answered [No] on all of the questions but feel you are really an [independent student] you will need to complete a [dependency override] with your financial aid office. You must present a compelling reason for not including your parents’ financial information.

- If you do not live with your parents, check with your high school counselor to see if you might can be classified as an unaccompanied minor. The McKinney-Vento Act defines homeless children as "individuals who lack a fixed, regular, and adequate nighttime residence."

- If you qualify under McKenney-Vento, then you will be classified as an ‘independent student’ and will not be required to provide your parents’ tax information. You will work with your financial aid office since they will verify that you high school classified you as an unaccompanied minor.

- IF your parents have not completed their 2017 1040 (tax return) you might consider choosing [will file] and using their tax information from 2016. If you choose this option, you will be directed to the [Income Estimator]. You will complete your parent’s financial information section and you can even submit your FAFSA The advantage of this is that it can allow you to meet your college’s financial aid priority deadline.

- The only disadvantage is that you will need to do a FAFSA Correction once your parents have completed their 2017 (tax return).

- If your parents will not file a tax return you will still be asked how much income they earned for 2017. If they received state and/or federal benefits or retirement, they will put 0 for income. However, your parents will need to supply to your college’s financial aid office verification of these benefits (generally a year end statement).

- VERY IMPORTANT [Data Retrieval Tool]. If you parents

- filed their taxes and did not amended [added additional information at a later time] AND

- your parents filed their tax returns within 2 weeks electronically

- If you mother and father worked, MAKE SURE TO SPLIT THEIR INCOMES. If you mother made 24,000 and your father 20,000, don’t put that they each made 44,000.

- If you were not able to use the IRS Data Retrieval tool, use the helpful information on the right side of your FAFSA.

- If you parents do not have a social security number, you will click [Other options to sign and submit] . At the bottom of the page, you will click [PRINT SIGNATURE PAGE]. One of your parents will complete, and he/she will mail it to the Department of Education.

- Remember that each time you make a correction or add a college to your FAFSA, one of your parents must sign with a FSA ID and if they do not have a SS# they will sign a paper [PRINT SIGNATURE PAGE].

- Once you have submitted your FAFSA print and review your confirmation page. Look for your EFC.This is the amount your parents are expected to contribute to your education.

- Check to make sure you have all of the college your are thinking of attending listed. If there is a missing school, you will need to do a FAFSA correction.

- Look at the graduation rates of the college you applied to. The higher the graduation rate, the more likely it will be that you will graduate from college.

Go through this check list before calling the Federal Student Aid Office at 1-800-433-3243

- Check their filing status on their tax return.

- Make sure the address matches the one on their tax return.

Follow up/Verification

Step 3: Follow Up and Verification

What is Verification

If you have made any errors, correct them and log back in 24 hours later to see if your FAFSA has been processed.

The Student Aid Report will contain three important items you MUST check.

- FAFSA Status: processed, errors found, or additional information needed.

- You EFC [estimated family contribution].

- If you have been selected for verification, which means you will supply additional forms or tax information to your college’s financial aid office.

- Verification is a process to confirm the information you provided on the FAFSA is correct..

- Verification selection can be random or you may be required if your FAFSA data was incomplete, estimated or inconsistent.

- The U.S. Department of Education selects some students for the verification process. Others are selected if your college’s financial aid office finds conflicting information.

- You will contact your college’s financial aid office. Follow these steps.

- Check your email to see if your college financial aid office has sent you information about why you were verified and what to do next.

- Check your college financial aid account. Often this is how your financial aid office will let you know why and what to do about verification.

- Call or stop by your college financial aid office. You will want to find out exactly what they need from you.

- You will need to turn in specific documents, such as a tax transcript or social security end of your statement if you parents are retired.

- You estimated your parents income because they had not already completed their taxes.

- You were not able to connect your parents tax information with the IRS Data tool [most common].

- You have been randomly selected.

When you are flagged for verification, colleges will ask that you complete what is called a Dependent Verification Worksheet or an Independent Verification Worksheet. Most colleges create their own Verification Worksheets. You can pick these up at your college financial aid office or download them from your college’s financial aid website.

Verification sheets ask the same questions. They will ask for your parents’ income or source of financial assistance, such as social security benefits. You and your parents will need to sign the worksheet and you MUST turn them back in to receive financial aid!

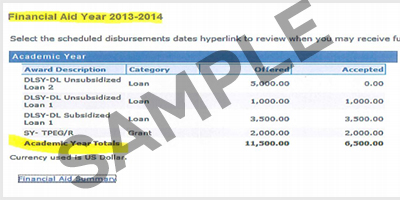

Your Award Letter

Step 4: Accepting your Award Letter

In the old days, colleges mailed an award letter to a student. Now, colleges expect you to log into your financial aid account and review your award letter online.

You should expect your award letter 4 to 8 weeks after your FAFSA has been processed. Remember, that before a college will send/create an award letter for you, you must FIRST clear up any verification issues.

If you do not receive an email from your college’s financial aid office in 4 weeks, you should contact them and find out why you have not received an award letter.

First, if you do not accept your award letter the college will assume you do not want financial aid. In other words, you won’t get any money!

Log into your college financial aid account and go to a section (generally called) award letter or accept award offers.

You will have the opportunity to accept or not accept your financial aid. You can accept all or part of your financial aid offer. If you do not want to take out loans, then you can decline them.Once you accept your financial aid , funds will be moved into your college account. You will also receive a college debt card in the mail, which will allow you to pay for books.

When you register for classes (sign up), you will be asked how do you wish to pay. You can apply your financial aid at this point.

- Contact your college’s financial aid office and explain to them your situation (you need additional grant funding to pay for college). If you parents have experienced financial hardships in the past few months, the college might lower your EFC.

- Consider less expensive schools. If you were accepted to a private school and will have to take out thousands in loans a year then you might consider a state college or attending a community college the first two years.